|

| Hubert Horan: Can Uber Ever Deliver? Part Thirty-Three: Uber Isnít Really Profitable Yet But is Getting Closer; The Antitrust Case Against Uber |

| nakedcapitalism.com |

| READ HERE |

| Highlights Of Hubert Horan's Excellent Article | |

| #1 They (Wamsley&Weinstein)incorrectly assumed that Kalanick was ousted by the Board because of bad publicity from various scandals, when the real reason was Kalanickís failure to implement the IPO as quickly as the early-stage investors wanted. |

#2 From a narrow P&L perspective Uberís recent moves to cut service and raise prices are sensible, but if openly discussed investors could realize that the entire corporate growth narrative was always a sham. |

| #3 Uber has abandoned everything that got the market to enthusiastically support them 10 years ago. Uber is now just a much higher cost version of the traditional operators they vilified as an ďevil taxi cartelĒ. | #4 It is hard to believe that Uber (or Uber/Lyft..) could continue to increase both prices and traffic volume. But unless the laws of supply and demand have been permanently reversed, they cannot use higher prices to drive ongoing revenue growth without choking off traffic growth. |

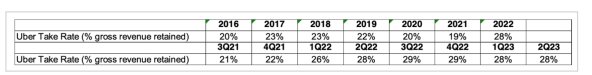

| #5 Thus 6-7% of Uberís 11% net margin improvement appears to come from the algorithmic price discrimination changes and the service cutbacks that allowed it to increasing its take rate from 22% to 28-29%. |

#6 Uber has reverted to the more economical traditional taxi approach, focusing on the narrow area of cities with the densest demand.* *which means more congestion |

| #7 Now different passengers/drivers making the same trip can see very different fares/payments. System average revenue per trip goes up, average driver payments per trip go down. |

#8 Uber has developed algorithms for tailoring customer prices based on what they believe individual customers would be willing to pay and tailoring payments to individual drivers so they are as low as possible to get them to accept trips. |

| #9 Starting in early 2022, Uber began keeping a larger share of gross customer payments and giving a smaller share to drivers. |

#10 Uber abandoned some hopelessly unprofitable overseas markets* and shrank back to being a pure car service and food delivery company (plus a tiny freight operation) |

| #11 Uberís claim that the financial improvement was driven by revgrowth makes no sense..its much more robust pre-pandemic revgrowth led to multi-billion-dollar losses demonstrated Uberís lack of significant scale economies.Expanding unprofitable operations just increases total losses |

#12 The reported $394mn 2nd qtr profit ($237 mn for the first half) was entirely explained by an alleged $386 million 2nd qtr gain ($707 mn in the first half)in the value of untradable securities they hold in coslike Didi,Grab, and Aurora that have nothing to do with their ongoing operations. |

| #13 Hubert argues that Uber has taken all of its margin-improving tactics as far as they go (save perhaps restructuring UberEats) and projecting more increases would be a mistake. |

#14 Hubert highlights one factor driving margin improvement which may not have gotten the attention it deserves; Uber using data about individual driver and passenger behavior to tailor prices so as to better fleece them. |

#15 |

The Following was not in the article.This is TLC reported #16 Numerous articles on Ubers numbers have said that number of trips is back to prepandemic levels. In NYC, which is Ubers biggest market, this is doubtful. Comparing Apr/May 2019 Uber/Lyft to Apr/May 2023 Uber/Lyft trips are down 11%. |